Using a DI document to:

- Assess use tax for the current or a previous fiscal year

- Reverse use tax from a credit received in a previous fiscal year

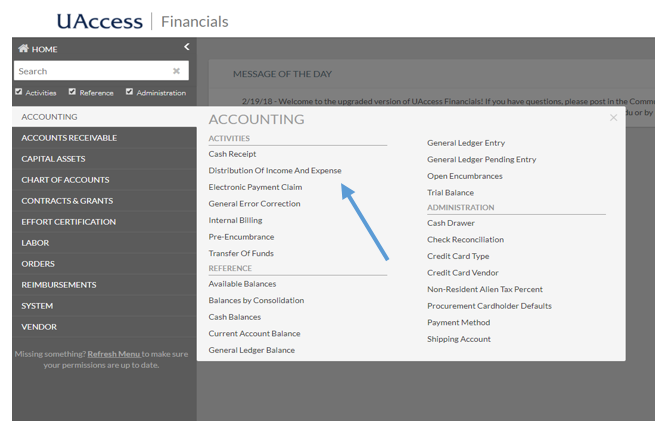

- Go to UAccess Financials and log in

- Click on Accounting > Distribution of Income and Expense

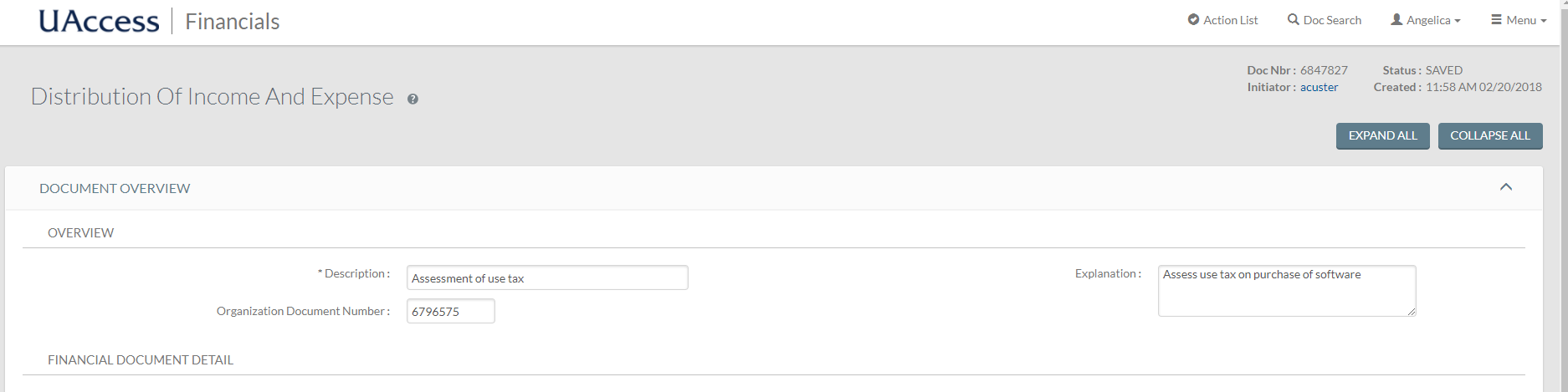

On the newly opened DI screen, complete the required fields:

- Description - “Assessment (or reversal of credit) of use tax”

- Organization Document Number - Enter the original PCDO e-doc #

- Explanation - Brief explanation why the correction is needed. Use tax assessments are justified when the original purchase meets all of the following criteria:

- Qualifies as tangible personal property,

- Is used or consumed within the State of Arizona,

- Is not eligible for a use tax exemption, and

- Was not charged sales or other excise tax of at least 5.6% by an out-of-state vendor.

Use tax reversals for a prior year credit are justified when the original purchase was not subject to use tax, but use tax was mistakenly assessed on the subsequent credit or refund. Providing the original purchase and refund/credit eDoc number is appreciated.

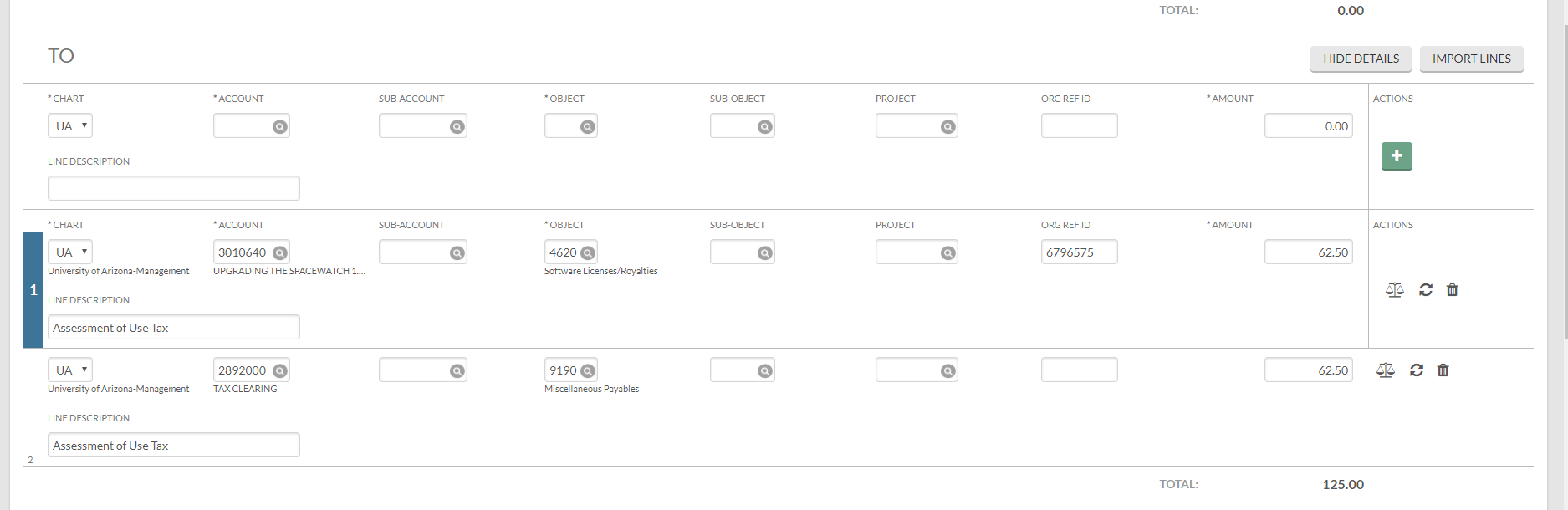

- Go to the Accounting Lines tab to create entries to increase the use tax expense and use tax liability

- On the first TO line, add information from the original PCDO

- Chart Code - UA

- Enter Account and Object Code in which the original expense was charged, including Sub-Account and/or Sub-Object Code if applicable

- ORG REF ID - the original PCDO e-doc #

- Enter amount of use tax to be assessed in the Amount field

- Line description - “Assessment (or reversal of credit) of use tax”

- Click the + (Add) button

- On a new TO line, add:

- Chart Code - UA

- Enter Tax Clearing Account 2892000 and Miscellaneous Payables Object Code 9190

- ORG REF ID - the original PCDO e-doc #

- Enter amount of use tax to be assessed in the Amount field

- Line description - “Assessment (or reversal of credit) of use tax”

- Click the + (Add) button

- Add any additional relevant information on the Notes and Attachments tab and click Save.

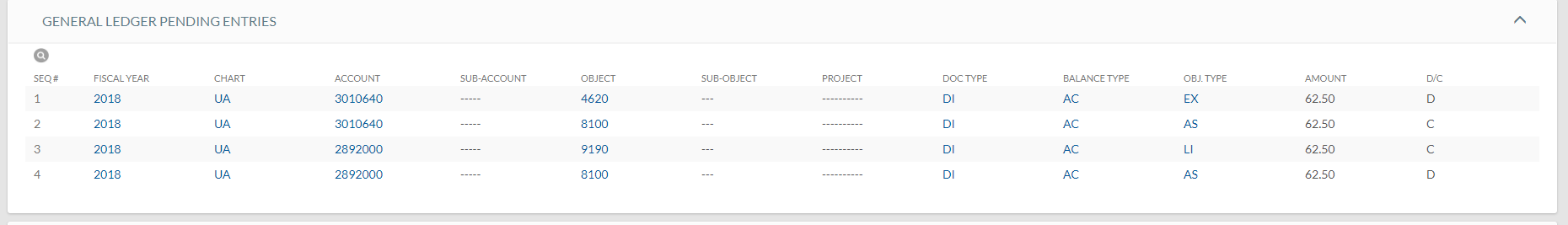

- Review General Ledger Pending Entries to verify credits and debits are posting to the correct accounts and object codes.

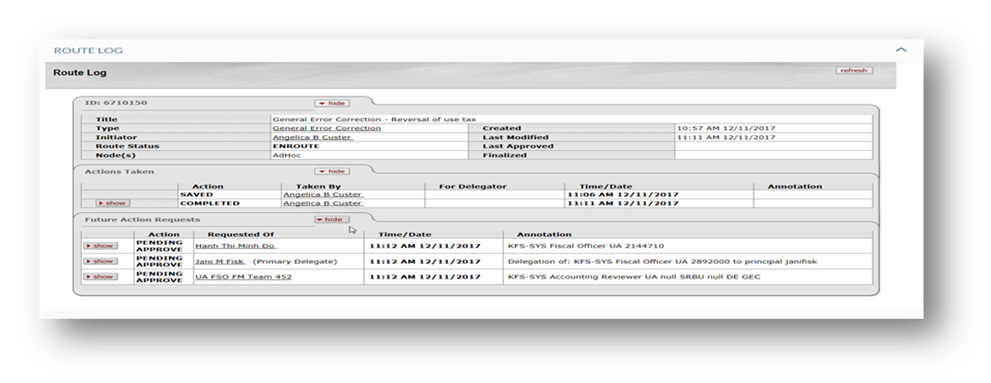

- Click on the Route Log to view the Future Action Requests and next steps

- Click Submit to process the DI